What is Internet Banking?

Internet banking, also known as online banking, is a service that allows customers to perform banking transactions electronically, using the internet. It provides customers with the convenience of accessing their bank accounts and conducting financial transactions from anywhere with an internet connection.

Who Invented Internet Banking?

While there is no single individual credited with inventing internet banking, it was a gradual development that emerged in the late 1990s. Many banks and technology companies contributed to its growth and adoption.

There is no recognized “father of internet banking.”

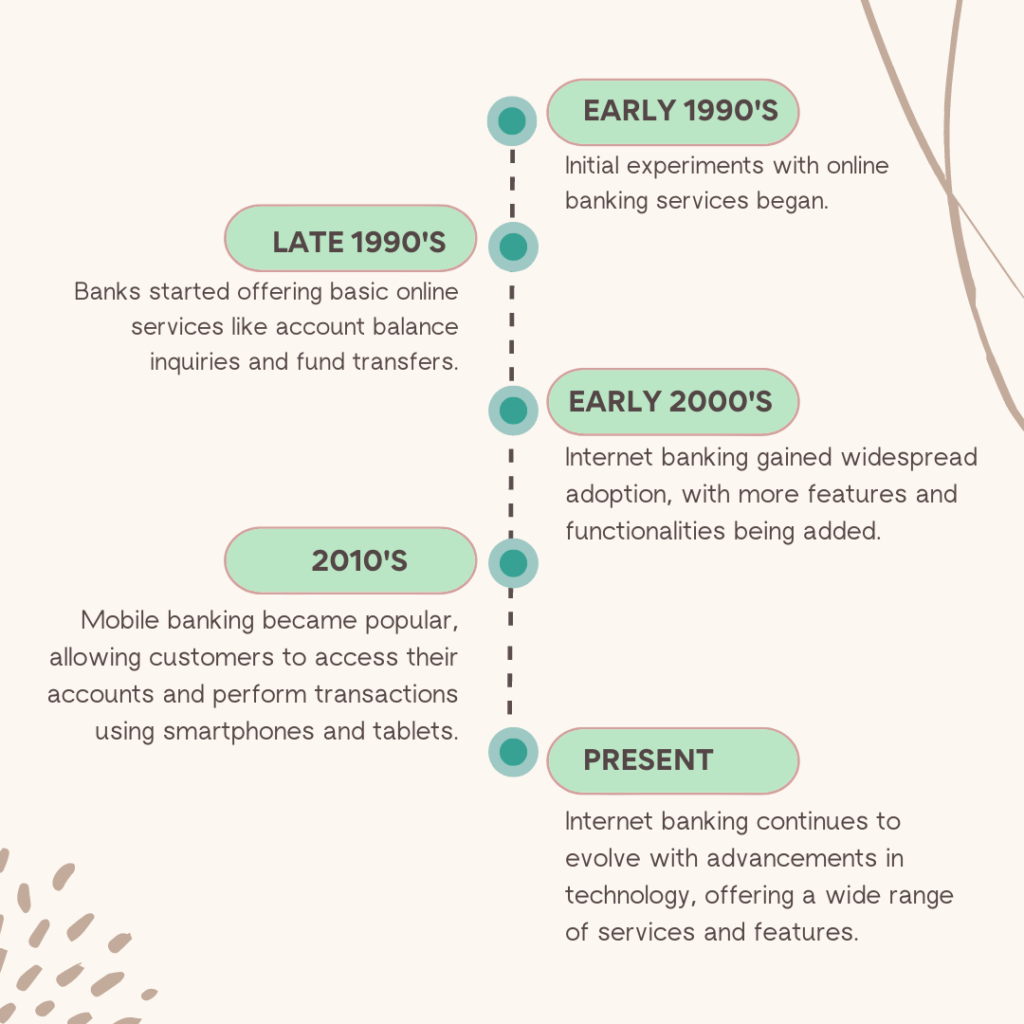

History of Internet Banking

Evolution/Stages of Internet Banking

- Basic Online Access: Initial stage with limited features like account balance checks and fund transfers.

- Expanded Services: Introduction of bill payments, loan applications, and other financial services.

- Mobile Banking: Integration of mobile apps for on-the-go banking.

- Personalized Experiences: Use of AI and data analytics to provide tailored recommendations and services.

- Open Banking: Sharing of customer data with third-party providers to enable innovative financial products and services.

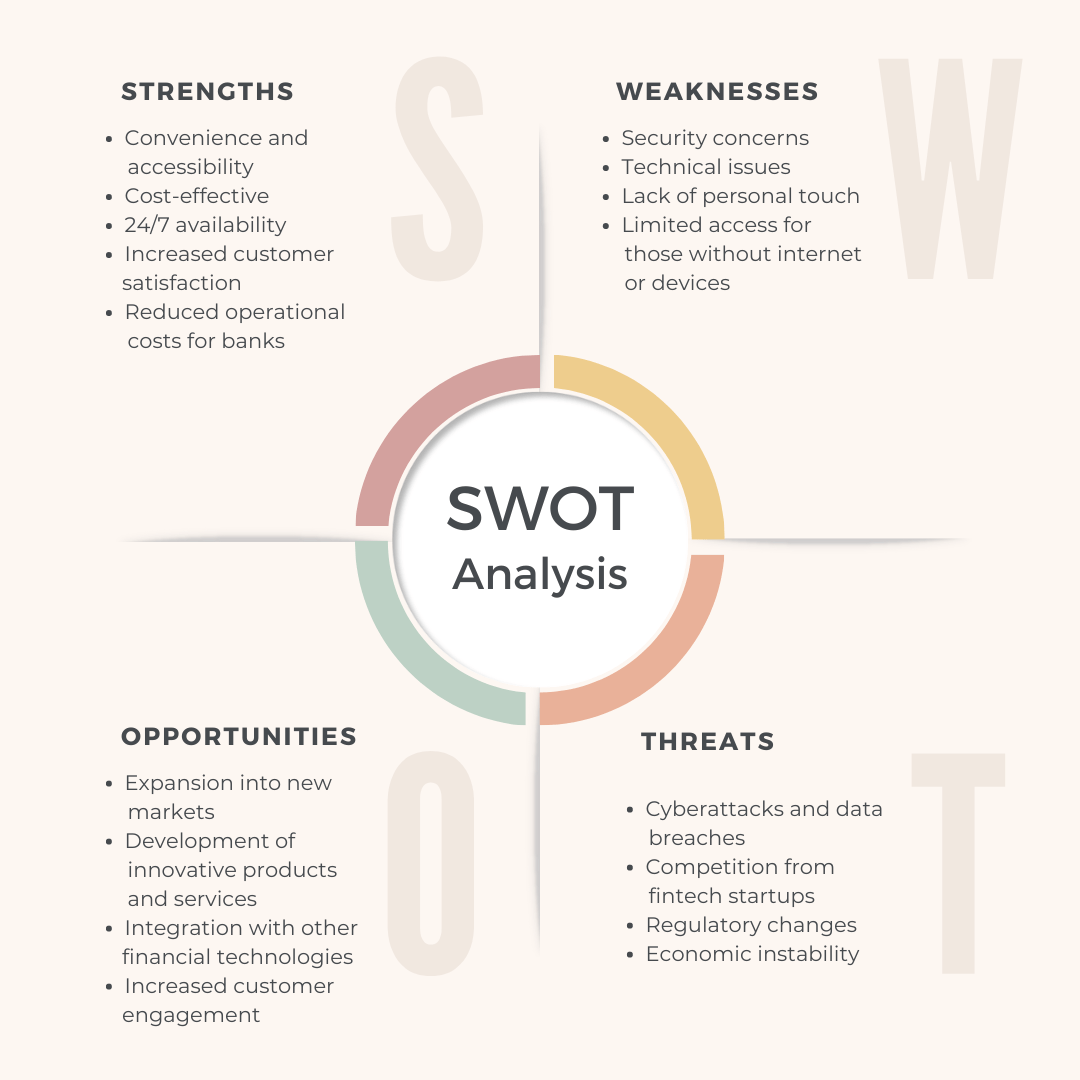

SWOT Analysis of Internet Banking

Why Should Banks Invest in Internet Banking?

- Enhanced Customer Experience: Offers convenience and accessibility, leading to increased customer satisfaction.

- Cost Reduction: Streamlines operations, reduces overhead costs, and improves efficiency.

- Increased Revenue: Generates new revenue streams through fees and commissions for additional services.

- Competitive Advantage: Positions banks as modern and technology-driven institutions.

Effect of IB on the BFSI Sector

- Increased Competition: Forced traditional banks to adapt and innovate to compete with fintech companies.

- Improved Customer Service: Banks have focused on providing better customer experiences to retain and attract customers.

- Shift in Business Models: Many banks have moved towards digital-first strategies, emphasizing online and mobile channels.

- Increased Efficiency: Automation and digitization have led to more efficient operations and reduced costs.

Is Internet Banking Secure?

While internet banking is generally secure, it is essential for banks and customers to take precautions to protect their information. Banks implement robust security measures like encryption, firewalls, and authentication protocols. Customers should also be vigilant about protecting their personal information and avoiding phishing scams.

Features of Internet Banking

- Account Management: View balances, statements, and transaction history.

- Fund Transfers: Transfer money between accounts, to other banks, or to payees.

- Bill Payments: Pay bills for utilities, credit cards, and other recurring expenses.

- Loan Applications: Apply for loans and credit cards online.

- Investment Services: Buy and sell stocks, bonds, and other investments.

- Customer Support: Access help and support through online chat or email.

Types of Internet Banking

- Retail Banking: For individual customers, offering personal accounts, loans, and credit cards.

- Corporate Banking: For businesses, providing services like cash management, trade finance, and treasury solutions.

- Investment Banking: For institutional investors, offering services like mergers and acquisitions, IPOs, and securities trading.

Role of Internet Banking for Different Sets of Bank Customers

- Retail Customers: Provides convenience, accessibility, and a wide range of financial services.

- Corporate Customers: Streamlines financial processes, improves efficiency, and reduces costs.

- Investment Customers: Enables online trading, research, and portfolio management.

Role of AI in Internet Banking

- Personalized Recommendations: Uses data analysis to provide tailored financial advice and product suggestions.

- Fraud Detection: Identifies suspicious activity and helps prevent fraud.

- Chatbots and Virtual Assistants: Provides customer support and answers queries.

Role of UI/UX in Internet Banking

- User Experience: Ensures a seamless and intuitive user interface, making it easy for customers to navigate and use the services.

- User Interface: Designs the visual elements of the banking platform to be appealing and user-friendly.

- Tools for UI/UX Designing: Adobe XD, Figma, Sketch, Miro, Webflow, Zeplin

Good Article: https://www.theuxda.com/blog/digital-banking-case-study-ux-design-of-future-online-banking

Role of Multiple Languages in Internet Banking

- Global Reach: Enables banks to serve customers from diverse backgrounds and languages.

- Inclusivity: Promotes financial inclusion by making banking services accessible to a wider audience.

How Internet Banking Can Help Disabled People (ADA Compliance)

- Accessibility Features: Incorporates features like screen readers, keyboard navigation, and color contrast to accommodate users with disabilities.

- Compliance with Regulations: Adheres to accessibility standards like the Americans with Disabilities Act (ADA) to ensure equal access for all.

Are There Any Revenue Sources from Internet Banking for the Bank?

Yes, banks can generate revenue from internet banking through various sources, including:

- Transaction Fees: Charges for fund transfers, bill payments, and other services.

- Interest on Loans: Earns interest on loans and credit cards offered online.

- Investment Fees: Charges fees for investment services like trading and portfolio management.

- Product Sales: Generates revenue from cross-selling additional products and services.

Whether Internet Banking and Omnichannel Banking Are Interrelated?

Yes, internet banking is a key component of omnichannel banking. Omnichannel banking provides a seamless customer experience across multiple channels, including online, mobile, branches, and ATMs. Internet banking plays a crucial role in delivering the digital component of this experience.

Internet Banking Technology Providers

- Integrated with Core banking platforms: Temenos, Oracle Flex cube, Infosys Finacle, TCS BaNCS, Finastra, Backbase, Sopra, Capital Banking Solution and others

- Specialized Digital banking solutions: Modefin, AurionPro, Fiserv, CR2, Clayfin, Puresoftware,Tagit, iexceed and others

Future of Internet Banking

- Increased Adoption: Internet banking will continue to grow in popularity as more people become comfortable with online transactions.

- Innovation: New technologies like blockchain, biometrics, and artificial intelligence will drive innovation in internet banking.

- Open Banking: The sharing of customer data will enable new financial products and services.

- Personalized Experiences: AI-powered recommendations and tailored services will become more prevalent.

- Enhanced Security: Advanced security measures will be implemented to protect against cyber threats.

If you are a Bank or a Financial Institution and need help to implement Internet Banking Solution, you can DM to me.

This guide provides clear and detailed insights into internet banking, covering its features, benefits, and security tips. The well-structured content makes it easy for readers to understand online banking essentials.